Business Insurance in and around Bentonville

One of Bentonville’s top choices for small business insurance.

Cover all the bases for your small business

Help Prepare Your Business For The Unexpected.

When you're a business owner, there's so much to focus on. You're in good company. State Farm agent Serena Smith is a business owner, too. Let Serena Smith help you make sure that your business is properly insured. You won't regret it!

One of Bentonville’s top choices for small business insurance.

Cover all the bases for your small business

Protect Your Future With State Farm

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is temporarily closed. It not only protects your pay, but also helps with regular payroll costs. You can also include liability, which is crucial coverage protecting your company in the event of a claim or judgment against you by a consumer.

At State Farm agent Serena Smith's office, it's our business to help insure yours. Contact our wonderful team to get started today!

Simple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

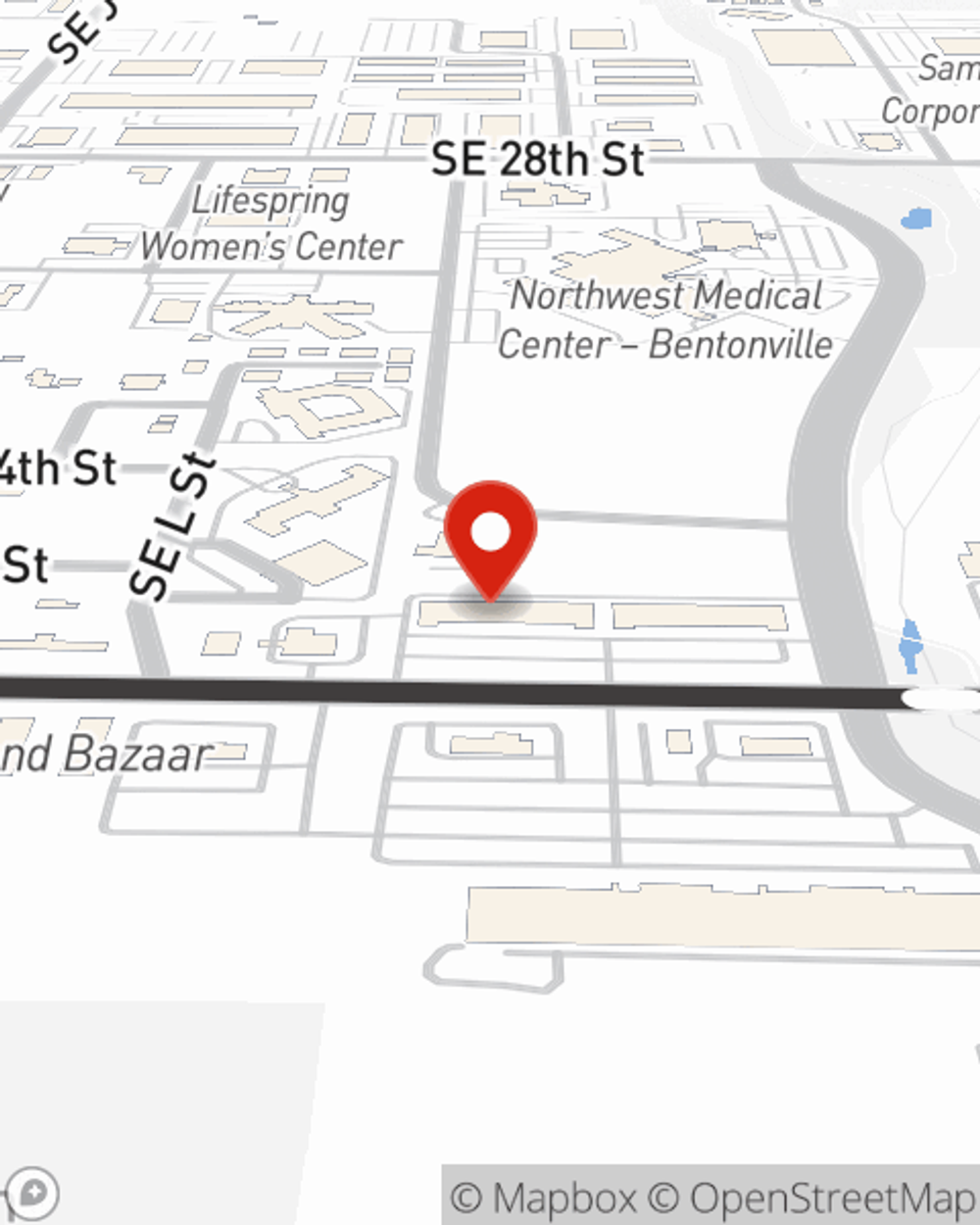

Serena Smith

State Farm® Insurance AgentSimple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.